1. Experience: Ti Time Company’s Broader Context

Ti Time Company, despite its roots in titanium, understands the significance of nickel due to its cooperative use in nickel–titanium alloys, stainless steel fittings, and high-performance equipment. Providing materials that interact well with titanium in multi-metal systems is a key area of our supply chain expertise.

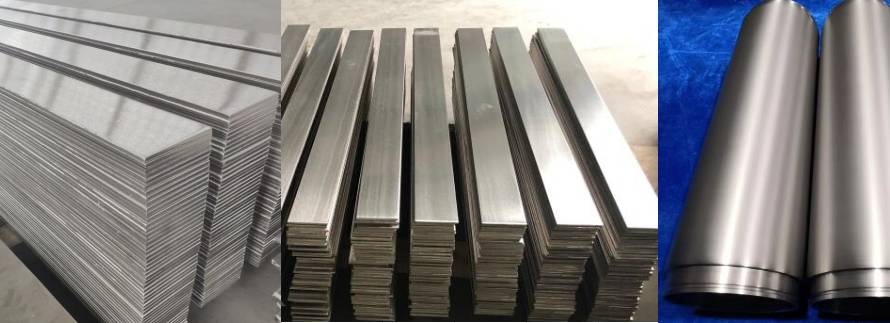

2. Nickel Products: Wide-Ranging Industrial Applications

Nickel is primarily used in:

Stainless steel: Enhancing corrosion resistance, ductility, weldability — key in construction, food processing, medical equipment

Nickel alloys: Including iron–nickel–chromium and copper–nickel, used in aerospace, petrochemical, marine, and electronics

Electronics & medical devices: Surgical instruments, battery components, and electronic housings.

Industrial applications: Heat exchanger tubes, commodity machinery, and power generation hardware

3. Nickel Price Overview – Mid‑2025

Current nickel prices hover around $15,000 per metric ton, influenced by market and supply dynamics:

YCharts / World Bank: $15,345.79 for May 2025 — up 1.54% monthly, down 21.65% annually

Trading Economics: ~$15,040, a modest 0.36% daily decline (as of June 19) .

Investing.com: ~$15,007.88 for nickel futures .

LME cash price: ~$14,785–$15,000 range

IMF / FRED: April 2025 average ~$15,146/ton

📉 Market Drivers:

Indonesian supply cuts (~35%) due to mining quotas

Oversupply & high inventory: LME warehouses hold over 200,000 tons

Trade tensions and subdued industrial activity impacting demand

4. Future Outlook

Wood Mackenzie / Reuters poll: Nickel expected to remain in oversupply, with moderate recovery to $16,750/ton by end-2025, $17,637 by 2026

Indonesia’s dominance: Controls over 60% of global refined nickel output and is shaping supply policies

EV & stainless steel end-use: Future nickel demand tied to those industries’ growth.

FAQs – Nickel Products & Price

What is nickel used for and why is it important?

Nickel is essential in stainless steel production, corrosion and heat-resistant alloys, battery tech, electronics, and medical tools

What’s the current nickel price per metric ton?

As of mid‑2025, nickel trades around $14,800–$15,400/ton, influenced by Indonesian supply controls and global oversupply .

Which countries dominate nickel production?

Indonesia leads with ~60% of refined supply, followed by Philippines, Russia, and Canada

Are nickel–titanium alloys relevant to titanium-focused suppliers?

Absolutely. NiTi (Nitinol) shape-memory alloys and stainless steel–titanium systems rely on high-quality nickel materials—areas where Ti Time Co. can help integrate sources.

How might price trends affect nickel sourcing?

Look for declines or stabilization in 2025–2026. Diversifying suppliers, verifying inventory levels, and aligning with EV/stainless steel production trends are key procurement strategies.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Ti Time Company’s Supply Edge

While rooted in titanium, Ti Time Company offers:

Nickel alloy sourcing for integrated structural systems

Consulting on multi-metal fabrication (e.g. stainless steel tacked to titanium)

Custom nickel alloy production, including Nitinol

Market insights and global sourcing strategies

Our expertise supports industries where nickel and titanium coexist.

Conclusion

Nickel is indispensable across multiple sectors — stainless steel, alloys, electronics, and aerospace. Prices remain subdued due to oversupply and stockpiles, with mid‑2025 levels around $15,000/ton, expected to stabilize. Ti Time Company, as a titanium specialist, extends its capabilities by sourcing nickel products, offering speculation-proof insights, and enabling integrated multi-metal solutions.